Are you prepared for the unexpected? Critical illnesses like cancer, heart attacks and strokes can strike at any time, leaving you facing not only health challenges but also financial burdens. Critical illness insurance provides cash benefits if you are diagnosed with a covered critical illness, giving you the financial support you need to focus on your recovery.

You can protect your family, finances, and future

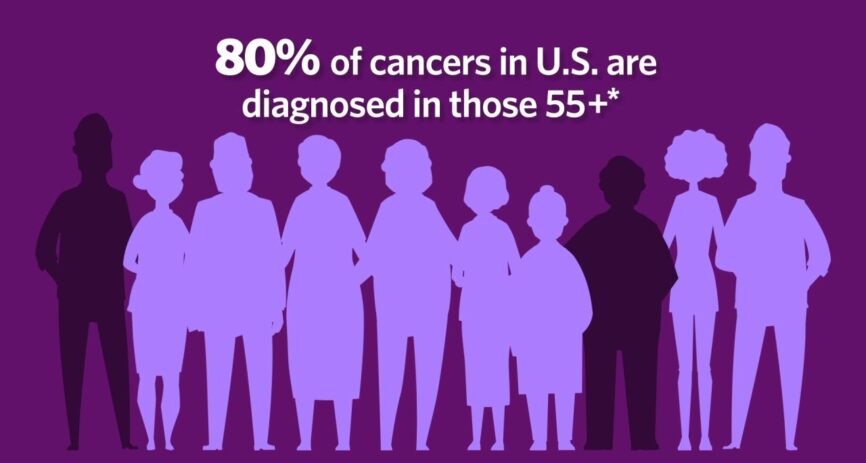

Buy supplemental insurance to help cover the extra costs of a critical illness diagnosis like cancer, stroke, diabetes, or Alzheimers.

Americans have cardiovascular disease today, according to the American Heart Association.1

people have a stroke each year, strokes are a leading cause of disability in the U.S. today.1

Critical illness insurance

Our critical illness insurance pays lump-sum benefits upon the first diagnosis of common conditions like cancer, heart attack, and stroke.

We offer coverage with cash benefits for up 17 critical health conditions, 14 types of accidental injuries and 7 other important categories.

Gary’s employer offered the critical illness policy, and he signed up right away. But then his wife lost her job, and Gary planned to cancel the coverage to save money. Before he got around to it, his wife was diagnosed with Stage IV lung cancer.

The policy immediately paid $37,500, which they used to arrange the best care and supplement their household income.

This example is provided for illustrative purposes only.

Covering Critical Illness

$11,000—that’s the average cost of a hospital stay.* Would you have enough savings to cover the bills if the unexpected happened? Hospital indemnity insurance can help cover the costs. Discover how Washington National can work for you! *Agency for Healthcare Research and Quality, Healthcare Cost and Utilization Project Statistical Brief #225, June 2017.

If you’re ready for more information about supplemental health insurance, let us know.

Fill out our simple form and we’ll have an agent contact you to discuss your insurance needs.

Or give us a call at (800) 525-7662, Monday-Friday, 8:00 A.M.-5:45 P.M. ET.